2022 witnessed the exploration of NFTs on a level previously unseen. NFTs started to shake off the stigma of simply being tokenised artwork that exists on the blockchain. Use cases for NFTs were expanded and tested, from collectable characters in gaming to digital twins in the luxury industry.

Despite the crypto downturn late in the year, and a predicted ongoing bear market, NFTs seem to be bouncing back. Whilst there was a decline in NFT sales towards the end of 2022, total NFT sales volumes reached nearly $1Bn in January 2023, an increase of 44.96% from the previous month which may suggest a bumper year for NFTs is ahead.

While that explains the financial outlook for the technology, what of the technological advancements? We’ve seen several changes in the way NFTs are used in business since they exploded onto the Web3 scene in 2021. However, one of the most significant advances we’re seeing is the evolution from purely static to Dynamic NFTs.

What is a Dynamic NFT?

Traditionally speaking, NFTs are non-fungible tokens secured on the blockchain that represent something specific, whether that’s a solely digital asset or a real-world asset represented digitally via an NFT. When an NFT is minted and added to the blockchain, the metadata that determines what the NFT represents is set and cannot be altered thereafter.

Static NFTs are most often built using the ERC-721 standard, where the token ID is singular and non-fungible, and a collection of NFTs is often deployed using a single smart contract, each token having a unique ID number. Dynamic NFTs tend to be built on both ERC-721 and ERC-1155, depending on the use case.

When tokens are built on the ERC-1155 standard, it creates a semi-fungible token set that has the same token ID for each token, but that is still different from any other set of tokens that exists.

These tokens act similarly to how gold and silver might act in the real world. Gold and silver are rare, valuable compounds that aren’t interchangeable with each other – you can’t swap gold for silver on a one-to-one unit basis (and get a fair deal), but you can swap gold for gold.

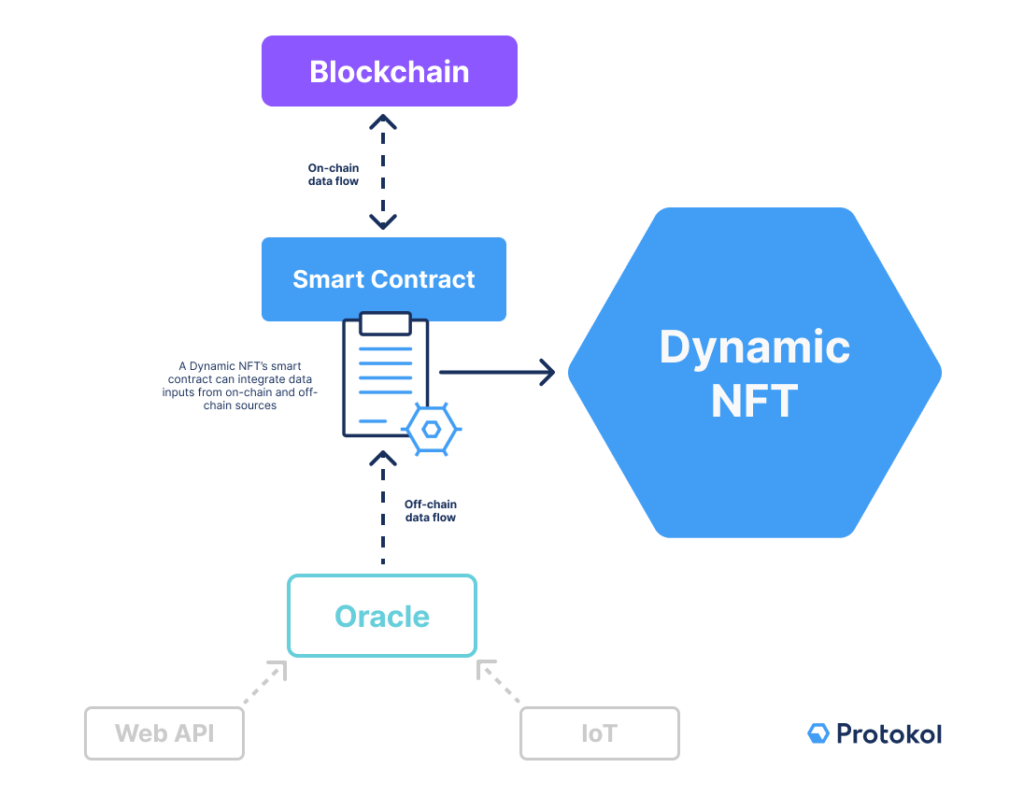

To create a Dynamic NFT, the initial NFT is minted using a governing smart contract. Another smart contract would be built into the metadata alongside the coded characteristics of the NFT. This internal smart contract provides instructions to the Dynamic NFT regarding updating its metadata if specified external events trigger the change.

This opens up further use cases for NFTs and allows off-chain data to be utilised within the space for the first time post-minting. The capability to use off-chain data represents another bridge between the Web3 ecosystem and existing Web2 IT infrastructure.

What makes NFTs dynamic is their ability to react to off-chain data inputs and make intelligent changes to the NFT’s metadata. That being said, an NFT doesn’t automatically become dynamic simply because its metadata changes – it matters how and why the metadata changes.

If, for example, you wanted to create a set of Dynamic NFTs that represent special membership tokens for a club or guild, you could use the ERC-1155 standard to mint these Dynamic NFTs and include a smart contract within the metadata.

This smart contract could be coded so that the owner, once a certain amount of time (a year, let’s say) has passed, gets a reward for holding the token – perhaps to thank the token holder for their continued support.

The external event (in this case, the passage of time) data would be fed into the Dynamic NFT via an oracle, and the reward could be the Dynamic NFT creating another direct copy of itself (or a token with the same ID) – doubling the recipients token holding and ownership stakes within the organisation.

With static NFTs, this process would have to be done manually, with separate tokens to represent the yearly membership achievement. With Dynamic NFTs, this is completely automated, having the capacity to massively increase the flexibility and scalability of NFT-related projects.

Oracles

Blockchain oracles are crucial in the off-chain exchange of data, acting as the communication and data channel for Web2 applications and the blockchain. Smart contracts themselves cannot access information outside of the blockchain network they’re built on, and so often rely on oracles to fill that role when off-chain data is required for their functionality.

Oracles are a collection of nodes and are not a storage mechanism for data in their own right. They qualify, query, and validate data from sources external to the blockchain and relay the information back to the attached smart contract, with some oracles even acting as two-way data streams.

Information sources that can be fed into oracles vary. A Web API connected to a trusted cryptocurrency market website could provide real-time updates on crypto prices, enabling the Dynamic NFT to change in a certain way based on this information.

An IoT-enabled thermostat could furnish a Dynamic NFT’s internal smart contract with temperature data; for example, if it’s an image depicting a landscape, this incoming data could change the background of the image to represent cold or warm weather where the thermostat is located.

Where the data is drawn from depends on the specific nature of the Dynamic NFT and what function the smart contract needs to fulfil based on that information.

Diagram depicting the process of altering a Dynamic NFT’s metadata.

Benefits and Drawbacks of Dynamic NFTs

Static NFTs are limited in the sense that once they’re minted, the data within them never changes. Dynamic NFTs offer a more flexible alternative to this with their semi-fungible attributes.

To add metadata to a static NFT, a new NFT needs to be created incorporating whatever changes or updates are required. When this process is done at scale, it burdens the blockchain network with all of the computing power needed to validate those transactions.

Since Dynamic NFTs can be updated via smart contracts, they can be used in NFT projects to reduce those computations, save on gas fees and present new avenues to scale up NFT projects.

However, there are potential downsides to Dynamic NFTs. Using oracles to query off-chain data comes with increased risk as third-party APIs can be fraught with security issues. If an oracle is compromised, the attacker can bypass the blockchain’s intrinsic security measures and break into the system.

Overall, the benefits of Dynamic NFTs seem to outweigh the potential risks. NFT projects can combine static and Dynamic NFTs to enable more operational flexibility and new use cases.

Dynamic NFT Use Cases

While Dynamic NFTs are quite a new innovation in the NFT space, they represent a lot of promise. Below are a few selected use case examples, but there are many more that exist and that will come to light as time goes on.

1. Gaming

Web3 games utilise in-game tokens as currency which can almost always be traded off the game on decentralised exchanges and mainstream, centralised versions such as Binance – this is central to the concept of GameFi.

Additionally, many games utilise (static) NFTs to add in-game value. NFTs allow for true player ownership of in-game items, such as weapons skins, player cards and other collectables. These NFTs are minted as the player makes an achievement and cannot be altered, forged or tampered with.

With Dynamic NFTs that can be altered after their initial minting, assets can be upgraded and downgraded, added to or subtracted from. For example, you could have a motor racing game where the NFTs involved are race cars.

Instead of unlocking a race car and that being the end of it, the game could mint a Dynamic NFT, having coded a smart contract that degrades the car over time in a realistic fashion and that allows you to add different modifications. This would greatly increase the game’s immersion.

Some Web3 games require the purchase of an initial NFT to start playing. What if rather than being simply a one-use point of entry to the game, that NFT was the player’s main avatar NFT?

If it was a Dynamic NFT, it could record the players’ achievements, skills-based statistics, and various other progression data. This would improve the scalability of the game and simplify the gameplay significantly.

With these clear benefits, it’s no wonder the Web3 gaming industry has been one of the more embracing stages for the exploration of Dynamic NFTs.

2. Real Estate

Tokenising real-world assets can be tricky, especially if the tokenised asset tends to change in value. This is the case in housing and real estate. House prices tend to fluctuate due to supply and demand, interest rates, maintenance work and an array of other factors.

Records must be kept up-to-date and accurate. If real estate businesses want to embrace Web3 and utilise NFTs by tokenising housing assets, it would be helpful to be able to update those NFTs with crucial data in real-time.

Utilising oracles for off-chain data, a real estate organisation could mint all of its housing stock as Dynamic NFTs, keeping an immutable record of maintenance work, sales and ownership credentials that can be updated as they change.

This will allow them to track the value of a property in perpetuity, which can potentially help Web3-savvy housing investors, as their property portfolio can update automatically through each building’s Dynamic NFT.

3. Fantasy Sport

Sports and NFTs have been intertwined since the inception of NFTs. They enable fans to connect on a deeper level to their favourite sports teams and athletes, often through tokenised trading cards, artwork and digital collectables.

Fantasy sports games, for example, use NFTs to tokenise a player for use within the game’s ecosystem. However, players in the real world change in ability and form all the time. To create an immersive environment within the fantasy sports game, the tokenised version of the player needs to be able to keep up with that.

Rather than releasing new NFTs every time a player’s stats change, fantasy sports providers could use Dynamic NFTs to represent players instead. These Dynamic NFTs can be updated via a blockchain oracle connected to a web API within the provider’s website, which can send data to a smart contract, updating the Dynamic NFT’s metadata and reflecting the player’s actual stats in real-time.

This would drastically improve functionality and reduce any associated fees and processing power, thus increasing scalability.

Conclusion

NFTs became popular in 2021. From their beginnings in the digital art world, these non-fungible tokens have been adopted across several industries, from gaming to luxury goods and beyond. However, one of the aspects that makes them what they are has also been identified as one of their biggest shortcomings – their permanence and their inability to be changed once they’re minted.

Dynamic NFTs are marking the next phase of evolution for the NFT market as semi-fungible tokens that can be programmed to change their metadata after they’ve been minted, adding flexibility and building a variety of exciting new use cases for NFTs.

Will the adoption of this new, adaptable token class be widespread? Only time will tell.

Key Takeaways

- Dynamic NFTs are semi-fungible tokens that allow a smart contract to alter their metadata after they’ve been minted, as opposed to static NFTs where the metadata remains unchanged after minting

- Dynamic NFTs are often built using the ERC-1155 standard

- Dynamic NFTs can make use of off-chain data sources to update their metadata

- Oracles provide the link between the Dynamic NFT and off-chain data sources such as Web APIs and IoT

- The ability to change metadata after minting reduces the need to update NFTs by minting new up-to-date tokens, reducing the computing power needed and cutting gas fees

- There are a multitude of use cases – including in the Gaming, Real Estate and Fantasy Sports industries